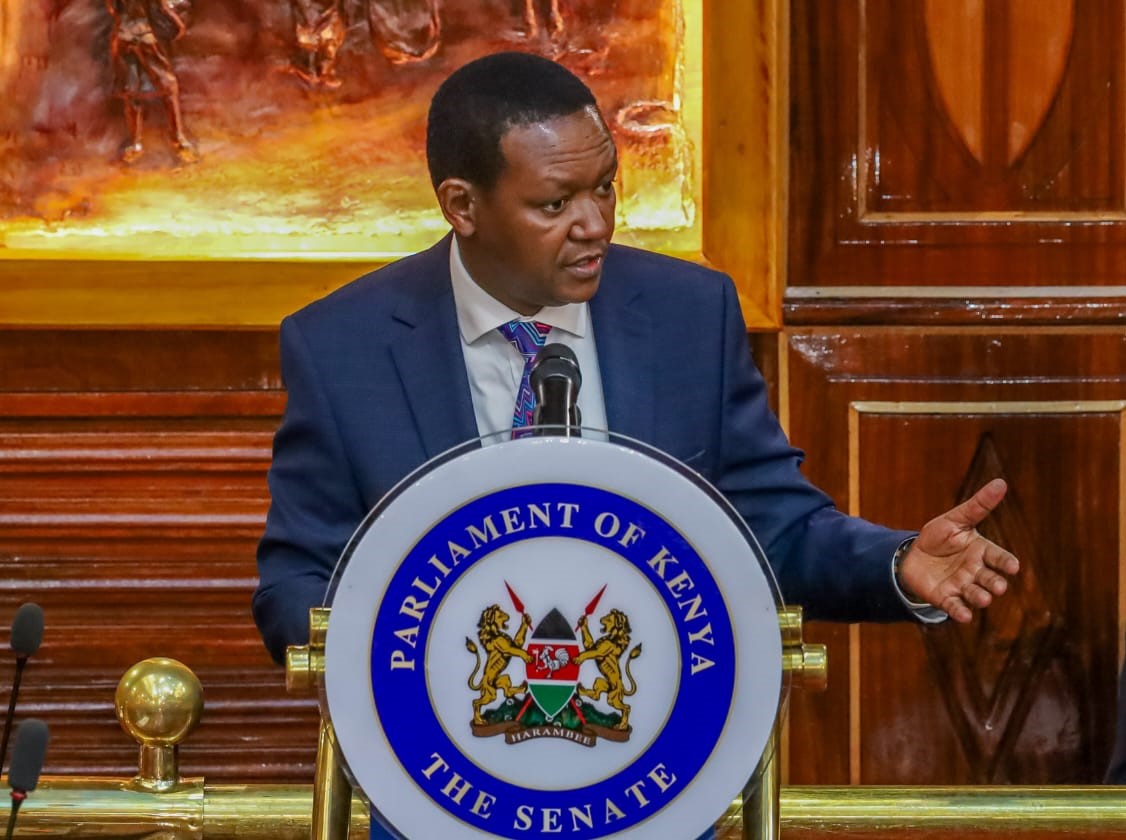

The Ministry of Agriculture and Livestock Development Cabinet Secretary, CS Mutahi Kagwe has called for a paradigm shift in agricultural financing, urging financial institutions to move away from short-term, high-interest lending and adopt long-term, low-interest facilities tailored to farmers’ realities.

Speaking at the 8th World Congress on Rural and Agricultural Financing hosted by African Rural and Agricultural Credit Association, CS Kagwe emphasized that Kenya’s agriculture sector which contributes nearly 50% of the country’s GDP directly and indirectly requires a financing model that matches its seasonal nature and capital cycles.

“We should stop locking-in farmers into short-term, high-interest facilities, and instead take a long-term view. Lend at low interest rates and encourage farmers to adopt modern methods by embracing technology. Push contract farming, sign futures contracts, and promote participation in commodities and futures exchanges,” said Kagwe

The CS revealed that the government is in the process of merging the Agricultural Finance Corporation and the Commodities Fund to create scale and efficiency in financing, while simultaneously raising AFC’s core capital to make it more responsive to farmers’ needs.

The CS further proposed the reinstatement of an earlier policy that required financial institutions to lend a mandatory percentage of their assets to the agricultural sector, noting that the current level of agricultural lending only 3% of total bank credit was an indictment.

ALSO READ:

CS Mutua defends sugar sector layoffs as legal, says reforms aim to restore stability

“We somehow abandoned this requirement along the way. This aggregated pool of funds will go a long way in providing sufficient, easily accessible capital at single-digit interest rates. It should be reinstated,” he said.

To sustainably fund agriculture, the CS proposed the establishment of an Agricultural Fund for AFC, modelled on existing exchequer-funded initiatives such as the Political Parties Fund (0.3% of revenue) and the Constituencies Development Fund (2.5% of national revenue).

“It therefore makes sense to support the agricultural sector by setting up a similar fund for the Agricultural Finance Corporation,” he added.

The Congress brought together policymakers, financiers, and development partners from across Africa, Asia, Europe, and the America. Although the Central Bank of Kenya Governor Dr. Kamau Thugge was scheduled to attend, he was represented by his Deputy Governor, who reaffirmed CBK’s commitment to developing frameworks that enhance credit access and risk management for the agricultural sector.

Kagwe also announced broader reform efforts within the ministry, including the establishment of a Projects Implementation Monitoring Unit (PIMU) to track sectoral investments, and the rollout of digital financing and farmer registration systems under the Kenya Integrated Agriculture Management Information System (KIAMIS), already covering 7.1 million farmers.

The Congress, themed “Innovating Finance for a Resilient and Inclusive Agri-Food System”, underscored the shared resolve among African nations to reform agricultural credit markets, promote digital innovation, and build farmer-centered financing systems to achieve food and nutrition security across the continent.

By Juma Ndigo

Get more stories from our website: Sacco Review.

For comments and clarifications, write to: Saccoreview@

Kindly follow us via our social media pages on Facebook: Sacco Review Newspaper for timely updates

Stay ahead of the pack! Grab the latest Sacco Review newspaper!