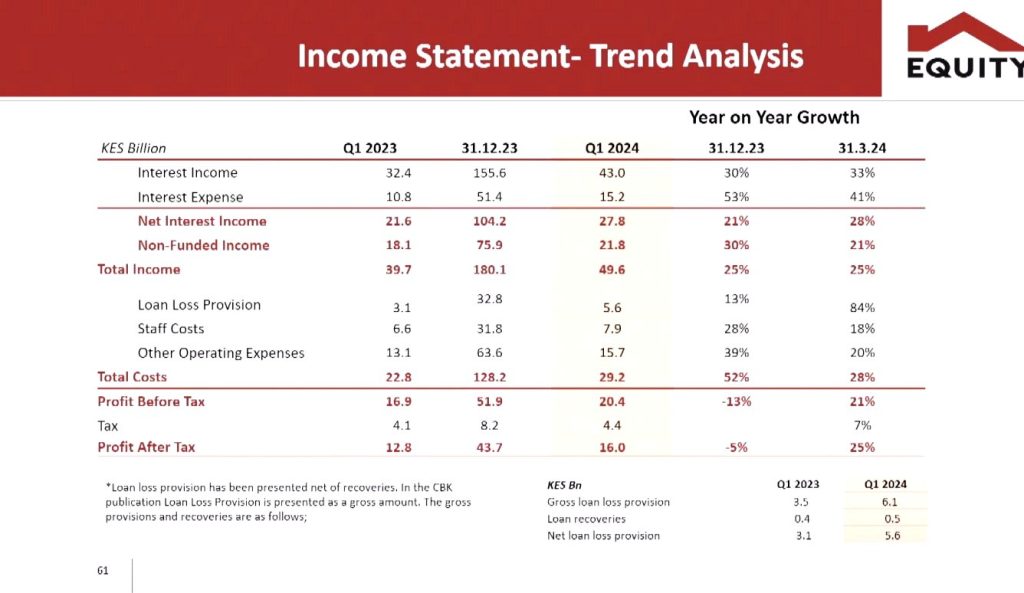

Kenya’s Equity Group announced today Monday, May 13, that its first-quarter pretax profit rose 21 per cent to KSh20.4 billion, helped by growth in interest income.

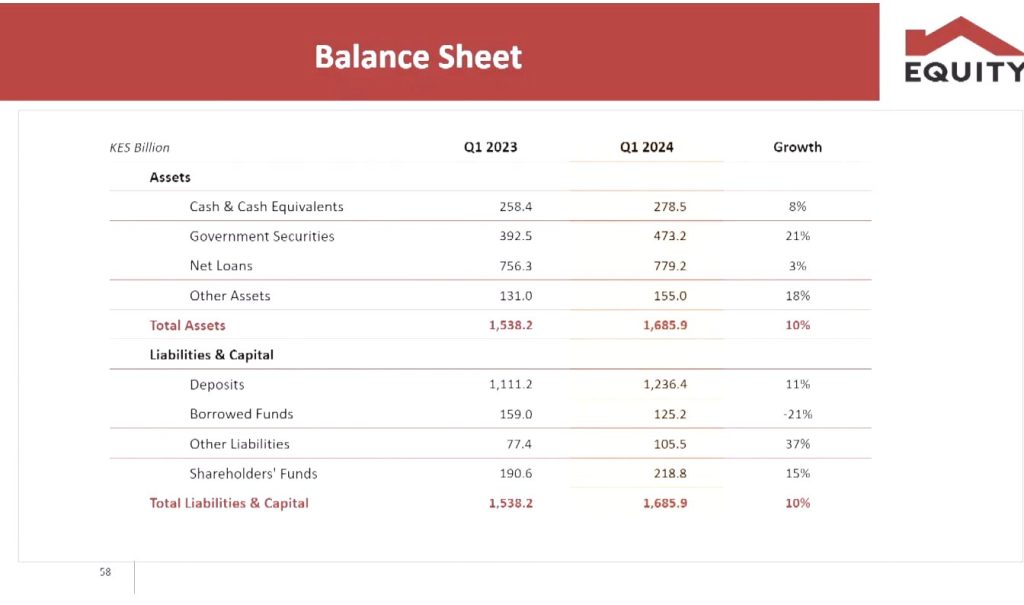

Equity, which also operates in Tanzania, Uganda, Rwanda, South Sudan, Burundi and Democratic Republic of Congo, said its net interest income increased to 28 per cent, translating to KSh27.8 billion.

“The regional banking subsidiaries contributed 63 per cent of the Kshs.20.4 billion profit before tax with a return on average equity of 27.6 per cent, cementing the Group’s position as the regional banking leader,” said Dr James Mwangi, Equity Group Managing Director & CEO, during Investor Briefing and Release of Q1 2024 Financial Results.

He added, that globally, the brand has been recognized as the world’s second strongest financial brand while regionally the brand is rated Africa’s strongest banking brand and East Africa’s most valuable brand.

READ ALSO:

“The Equity brand has become synonymous with financial services, banking and insurance, education through Wings to Fly scholarships and the Equity Leaders Programme, championing access in health through Equity Afia Medical Centers, Agriculture through Kilimo Biashara programme, entrepreneurship through Young Africa Works Program and sustainability through social safety net cash payments programs, tree planting and clean energy transitions (equipment and devices).

He also said that digitization and automation of processes has significantly enhanced convenience and ease to customers in self-serving using own devices and third party infrastructure which has shifted the cost structure of the Group from fixed cost to variable costs.

“The regional banking subsidiaries contributed 63 per cent of the KSh20.4 billion profit before tax with a return on average equity of 27.6 per cent, cementing the Group’s position as the regional banking leader, “ the CEO added

Get more stories from our website: Sacco Review.

For comments and clarifications, write to: Saccoreview@

Kindly follow us via our social media pages on Facebook: Sacco Review Newspaper for timely updates

Stay ahead of the pack! Grab the latest Sacco Review newspaper!