The country’s Sacco umbrella body, Kenya Union of Savings and Credit Co-operative (KUSCCO), has warned the entities against declaring unrealistic dividend payouts in a bid to retain membership.

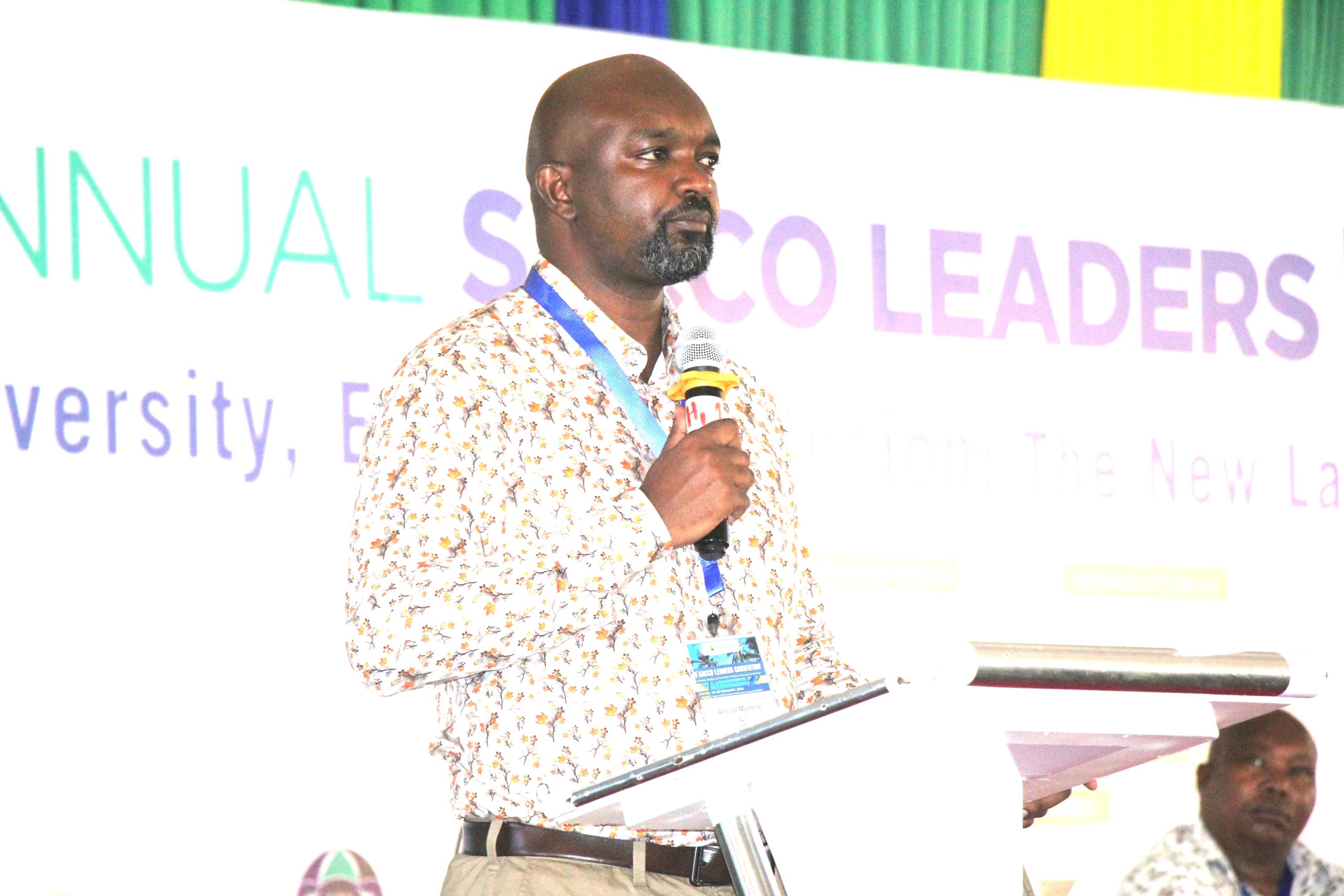

Speaking during Imarika Sacco’s Annual Delegates Meeting (ADM) in early March at Travellers Beach Hotel in Mombasa, KUSCCO Acting Managing Director Arnold Munene noted that it is unsuitable for Saccos to pay out huge returns to members while struggling to meet their overhead costs.

Munene urged Saccos to embrace good leadership and good governance for effective operations, urging top officials to exercise a high degree of transparency, accountability, integrity and honesty while discharging their daily duties to enable them to operate in a more efficient and effective way, hence win trust from the people they serve.

He urged Saccos in the country to develop a high sense of focus towards achieving their dreams.

The same was echoed by Kenya Teachers Sacco Association (KETSA) National Chairman Robert Njue, who also urged Saccos to embrace good leadership and good governance for smooth operations.

Njue urged Kenyans to develop a saving culture for better returns at the end of the transaction period.

READ ALSO:

Windfall for Sacco members as huge dividends, rebates are paid in 2024

Separately, Commissioner for Co-operative Development David Obonyo challenged Sacco members to focus on getting affordable loans from their Saccos rather than high dividends.

Speaking during a recent Hazina DT Sacco’s ADM in Nairobi, Obonyo asked members to have long term investments through the Saccos since cooperative societies work in the best interest of members.

“Make use of your Saccos by taking loans and starting businesses. You should not be giving too much pressure on getting dividends every year,” he advised.

The commissioner also asked Saccos to start mortgage products for members to acquire properties at affordable prices.

He also challenged participants in all Saccos to interrogate figures presented to them during the ongoing ADMs around the country and should elect people of high integrity and good character to take care of their resources.

He said governance is a big issue in most cooperative societies and added that most Saccos become bankrupt because of delegates’ decisions; some demanding extremely high dividends that make the institutions struggle financially.

Cooperative Insurance Company (CIC) Manager in charge of Coast and North Eastern regions Samiri Luvusia urged Saccos in the two regions to insure their properties for safety purposes.

This will enable them to operate without any fear of theft and bulgary, he said.

Cooperative Bank’s Coast Regional Public Relations Officer Collins Kai asked Saccos in the region to adopt Information and Communication Technology (ICT) to enhance service delivery to members.

Kilifi County’s Cooperative Development Chief Officer George Katana Mwangiri told Saccos in the county to embrace member education and training to enable members to be conversant with their Sacco affairs.

Kilifi County Cooperative Deputy director Mary Mkare said the county government will continue to offer technical advice to Saccos in the county.

By Tsozungu Kombe

Additional reporting By Obegi Malack obegimalack@gmail.com

Get more stories from our website: Sacco Review.

For comments and clarifications, write to: Saccoreview@

Kindly follow us via our social media pages on Facebook: Sacco Review Newspaper for timely updates

Stay ahead of the pack! Grab the latest Sacco Review newspaper!