The Treasury has withdrawn its intention to increase the excise duty on mobile money transactions, providing a reprieve to millions of users who depend on these services, such as Safaricom’s M-pesa.

National Treasury Cabinet Secretary Njuguna Ndung’u has rolled back the proposal to increase the excise tax duty on mobile transfer services from 15 per cent to 20 per cent.

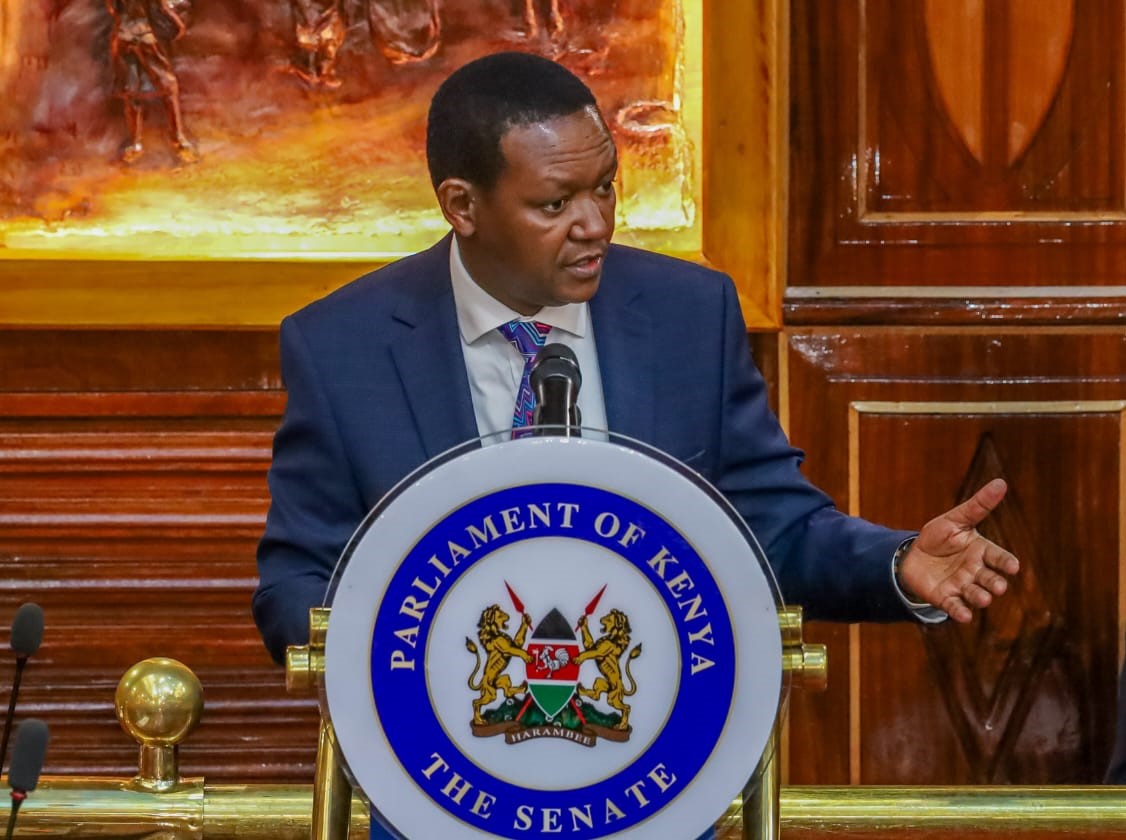

“I propose to retain the excise duty rate of 15 per cent on fees charged on money transfer services by cellular phone service providers to benefit the retailing electronics payments ecosystem,” said Ndung’u while presenting his 2024/25 Budget speech to Parliament.

Safaricom, the company that dominates over 98 per cent of mobile money transactions, voiced its opposition to the proposal during public hearings on the Finance Bill 2024. They argued that an increase in taxes on mobile money transfers would undermine the progress made in financial inclusion and could potentially encourage the use of unregulated money transfer options, which would negatively impact tax collection efforts.

Safaricom had also made the point that mobile transfer fees have traditionally been less than those of other financial transactions. This acknowledges the fact that the mobile money transfer sector caters to the community without access to traditional banking services.

“The cost of transactions will prevent ordinary mwananchi from accessing crucial services,” a representative of the telecommunications company expressed to MPs last week.

READ ALSO:

For the fiscal year concluding on March 31, 2024, Safaricom announced a 33.9 per cent surge in M-Pesa transactions, rising from 21.2 billion to 28.3 billion transactions.

Meanwhile, the worth of the transactions rose by 9.6 per cent from the previous year, increasing from KSh36.7 trillion to KSh40.2 trillion, underscoring the significance of the mobile money ecosystem. In the given period, Safaricom earned KSh139.9 billion from service fees, up from KSh117.2 billion in the previous period.

Statistics from the Kenya National Bureau indicate that the total value of mobile money transactions reached KSh7.95 trillion in 2023, reflecting a slight increase of 0.57 per cent from KSh7.9 trillion the year before. This represents the most sluggish rate of growth in the value of mobile money transactions over the past four years.

Despite this, the National Treasury has maintained its plans to increase the excise duty on telephone and data services, as well as the fees for money transfer services provided by banks, money transfer agencies, and other financial service providers, from 15 per cent to 20 per cent.

The proposal has upset stakeholders in the industry, including the Kenya Bankers Association (KBA), who view the move as a setback to the advancement of financial inclusion. Analysts at the consultancy firm KPMG predict that the number of mobile money transactions will probably decrease, which would negatively impact the collection of excise duty.

“The increase in excise duty on telephone and internet data services, fees charged for mobile transfer services and other financial services may lead to a decrease in the number of transactions thus may see a decrease in excise duty collection,” KPMG said in a note.

By Frank Mugwe

Get more stories from our website: Sacco Review.

For comments and clarifications, write to: Saccoreview@

Kindly follow us via our social media pages on Facebook: Sacco Review Newspaper for timely updates