Savings and Credit Co-operative Societies (Sacco’s) have continued to play a significant role in promoting economic interest of their members.

In Kenya, their role in uplifting lives in the community through financial inclusion cannot be overlooked.

Saccos have helped members to mobilise savings and borrow in turn for investments in enterprises and personal development, thus empowering their social economic status.

The Vision 2030 blue print identifies Sacco’s as vital players in deepening financial access, the reason why the Government has been in the forefront in supporting their growth.

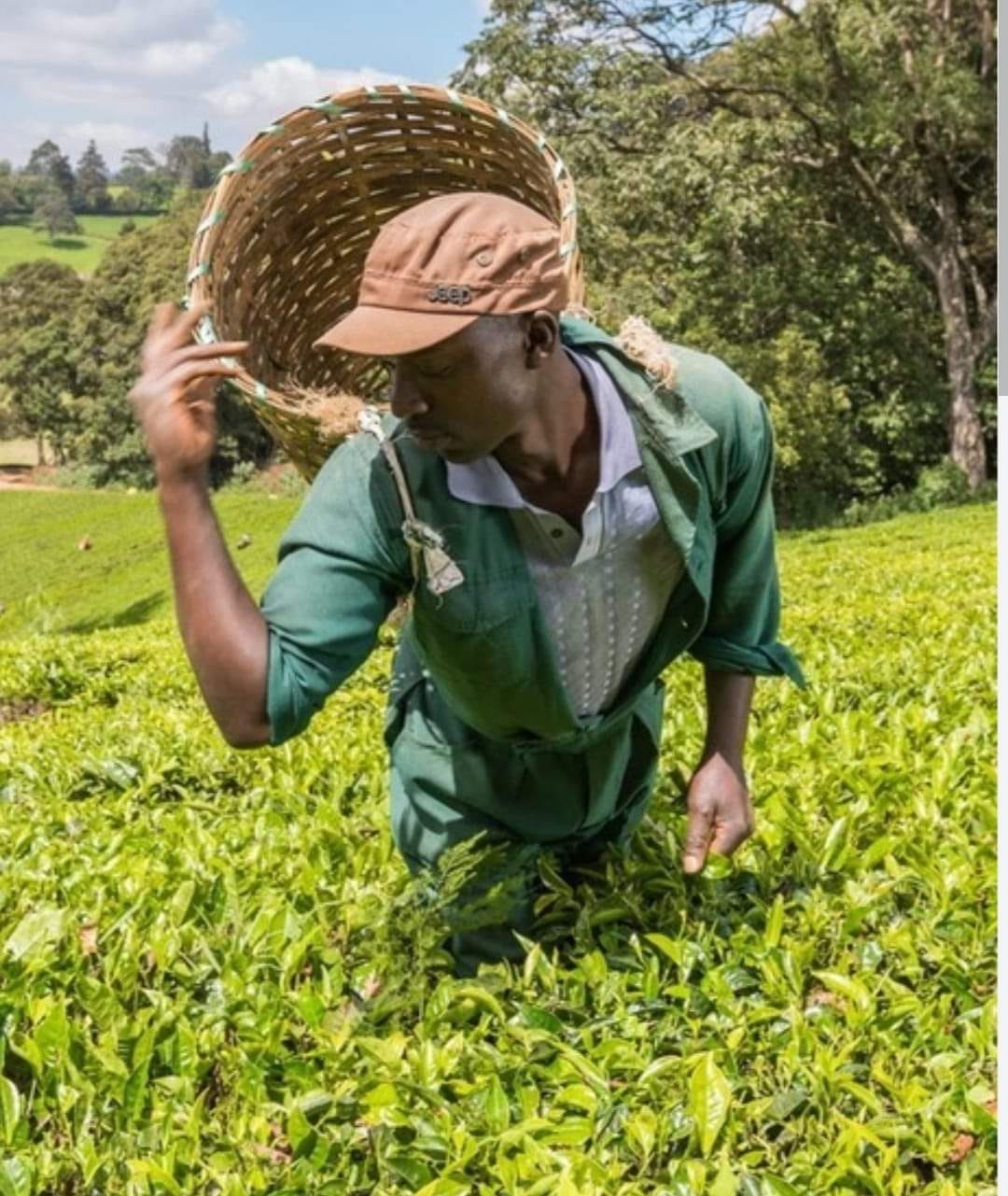

Today Saccos are an integral part of the Government economic strategy focusing on creating income-generating opportunities especially in rural areas.

The societies provide an alternative to banks for low-income earners who need financing.

The flexibility of Saccos to provide loans at relatively low interest rates has attracted members and contributed to their growth across Kenya.

The favorable terms and conditions of borrowing have meant much easier access to credit from Saccos compared to commercial banks.

Therefore, this is an emerging key role of Saccos in development, specifically in terms of financial inclusion.

Recently, the World Bank released a report calling for the turning of Saccos into banks to lower cost of credit in Kenya.

The report sanctioned by the Central Bank of Kenya outlined a raft of reforms that should be unveiled to replace the law capping interest rates.

In Saccos, net profits are shared between all members in the form of dividends, based on a member’s shareholding percentage, while in a bank only the shareholders receive a share of the profits.

We also urge county governments to play their part in encouraging formation and growth of Saccos in their counties.

Sacco Review | The Leading Newspaper for Co-operative Movement in Kenya

The Leading Newspaper for Co-operative Movement in Kenya