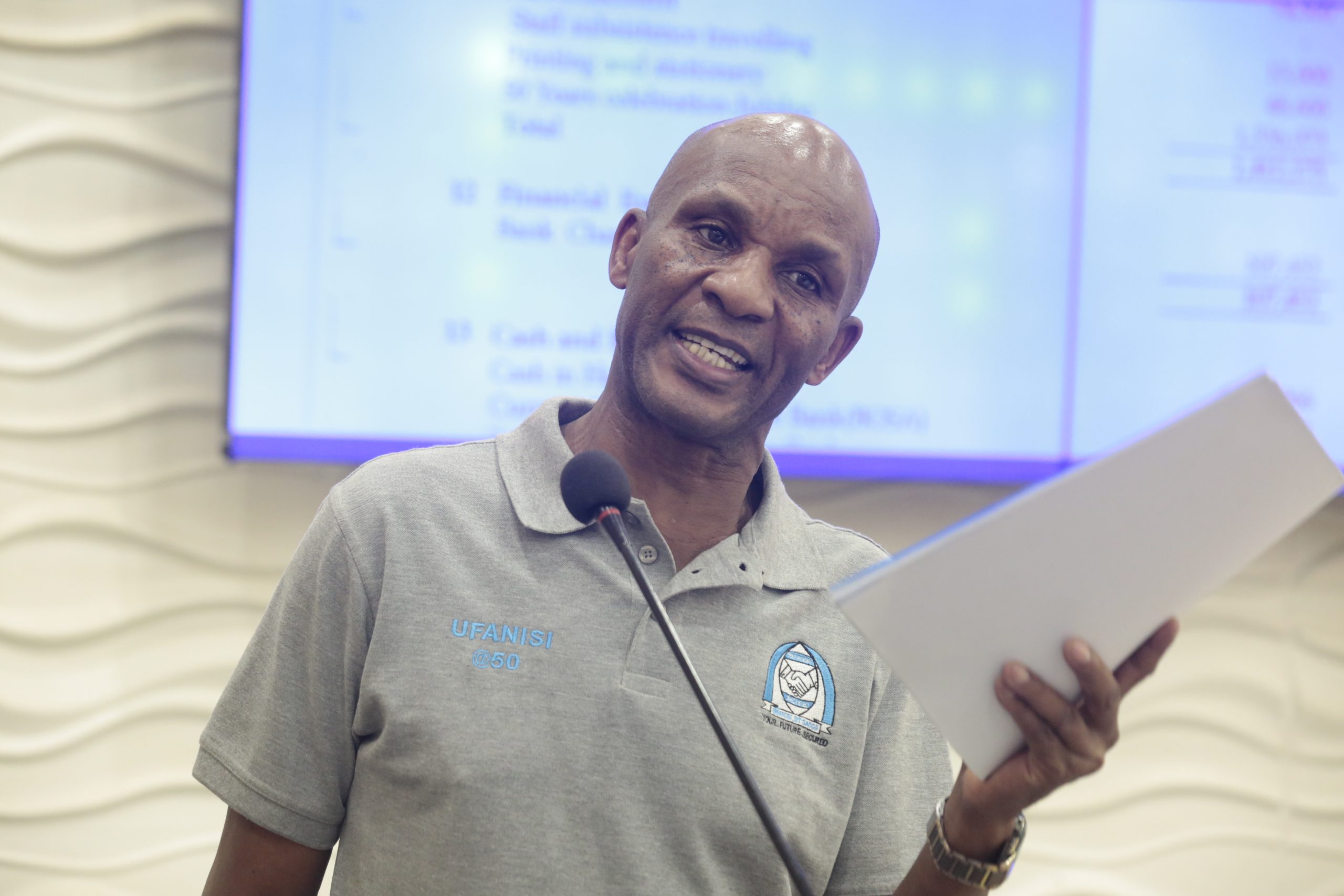

After a happy 40 years in the cooperative movement, where he rose through the ranks to become one of the renowned leaders, CPA Frederick Masoso Abuyabo, the immediate former Chief Executive Officer (CEO) of Ufanisi Deposit Taking Sacco, hang up his boots.

His handwork and determination have seen him climb the career ladder from a humble bookkeeper to a notable position as a CEO. Abuyabo is among the few SACCO bosses lucky to have gone through all ranks in the cooperative circles.

He recalls with nostalgia the strict and rigorous process people would undergo while making bank transitions. “I started my career when banks would close at mid-day, and the District Co-operative Officer‘s (DCO’s) signature was mandatory in the bank for a co-operative cheque to go through, which served as a stringent measure,” he observed.

By then, for the cheque to be signed, the DCO had to scrutinize loan registers and bank statements since the Commissioner was strict on member’s service delivery, which was on the First Come, First Serve Principle.

The long-serving co-operator started his career in the Marketing Co-operative Society, where he served for 4 years as a secretary manager at Ndalu Farmers’ Co-operative Society between July 1985 and April 1989, with the remaining years of his career spent in the Savings and Credit Co-operatives (Saccos).

From Ndalu Farmers’ Co-operative Society, CPA Abuyabo moved to Bungoma Teachers Sacco (now Ng’arisha Sacco) for 9 years, from May 1989 to January 1998. He joined the Sacco as a bookkeeper, and by the time he was leaving, he had risen through the ranks to the position of Investment Manager, where he had been seconded to then Bungoma Teachers Housing and Investment Co-operative Society.

He moved from Ng’arisha Sacco (formerly Bungoma Teachers Sacco) in May 1989 to join the Agricultural Finance Corporation (AFC)-based Sacco, Ufanisi DT Sacco, as a CEO from February 1998 until his retirement on January 31, 2025.

His dazzling career growth is a clear testimony to hard work, determination, and resilience. Subsequently, being at the helm of Ufanisi DT Sacco for the last 26 years, CPA Abuyabo has had its share of challenges, but through determination, he helped the Saccos record remarkable growth.

Furthermore, his 40 years stay in the movement is a clear indicator of his vast experience in the cooperative movement, more so in the Sacco sub-sector and the emerging issues in the movement. In a recent interview with Sacco Review reporter Roy Hezron, Abuyabo talks about the achievements he has realized for Ufanisi DT Sacco as the CEO, the lessons learned, life after retirement, his advice to Sacco leaders on best management practices, and how one can plan for retirement. Here are excerpts from the interview.

What achievements have you personally realized for Ufanisi DT Sacco since you took over?

Ufanisi DT Sacco was registered on July 6, 1973, as a Sacco for employees of AFC that has since opened its membership to the general public. The Sacco Society was registered with the Sacco Society Regulatory Authority (SASRA) on July 22, 2013, with major objectives of encouraging thrift among its members, affording them an opportunity to accumulate their savings, creating a source of funds where its members can borrow at a fair and reasonable interest rate, and providing its members with credit for provident and productive purposes.

I was in charge of the Sacco since February 1998; I enabled the Sacco to be among the first registered Deposit Taking Saccos by the Sacco regulator, SASRA. During my stay at the Sacco, I have also managed to reduce the loan backlog from 6 months to daily disbursements, increased member’s loyalty to the Sacco, and above all, increased the asset base from Ksh54.23 million in 1998 when I took over to the current Ksh444 million in December 2024 when I left.

Further, the Sacco records were automated in 2012 and members can access their records online 24/7, above all, when I am exiting Ufanisi DT Sacco, I am proud to state that during my tenure, the Sacco has never had external debt for more than 15 years.

I also managed to do Sacco AGMs every last weekend of March compared to before when it used to be done in September/October months. The Sacco has been paying interest on members’ deposits and dividends every year, and for the last four years, the Sacco has been paying interest of 9 percent and dividends of 17 percent.

Before I joined Ufanisi DT Sacco, the financial statements were being done by the Management Committee. During my tenure, I ensured that the statements were being prepared by the staff and then approved by the Board.

Other achievements include an increase in staff establishment from three in 1998 to seven as of January 2025, improved member services and loan turnaround time from six months to real time (for instance, emergency and medical loans), and also effecting board, staff, and member’ education as per cooperative principles as compared to before I took over, when there used to be no trainings that were being carried out.

During your career in the movement for the last 40 years, out of which 36 years have been in the Sacco sub-sector, what lessons have you learned?

The big lesson learned is that you cannot succeed without working with members who are the owners and customers at the same time. You need members to run the SACCO.

Regulation is very vital in running any institution, and in this regard, there was much growth when SASRA came into place compared to the previous period when the regulator wasn’t there.

Above all, hiring quality staff without favoritism motivates employees to achieve their targets to the advantage of the members’ growth and service delivery and implement members resolutions to earn members confidence at all times is key.

Now that you have retired, what advice can you give to your fellow SACCO CEOs and leaders who are still in the movement, particularly on good management skills and practices?

For Saccos to take their space in the financial sector, leaders should practice good corporate governance. It is only the cooperative movement that can reach every citizen due to its unique model—member-centered.

YOU MAY ALSO READ:

Vulnerable communities in Siaya County benefit from Climate-Smart Agriculture Funding

The management should urge the Board of Directors to empower its members through members’ education days. Sacco information updates are very vital. You need to move together with members by updating them on the position of the Sacco and industry at large; in short, be with the members always.

Also, the management should be member-centric. Since the member is the owner and customer at the same time, they should be treated equally, thus on a first-come, first-served basis. To add on that, when the management of Saccos adheres to SASRA and Commissioner for Cooperatives guidelines, it strengthens societies to the advantage of general members for security of their deposits and improved service delivery.

How is life after retirement, especially for a person who has held one of the most lucrative positions in the cooperative movement?

(Laughing) This is where you meet real life on the ground. There is little money circulation on the ground. Many people will move close to you thinking that you will solve all their financial constraints.

I am learning the rural steps as I do some farming. Things really changed as few people will call your mobile phone unlike when at the helm of power. You need to adapt to the reality.

I see you adequately planned for your retirement since you’re ever busy with activities and live happily with people here in the village. For those who are still in the active service, especially those in the top ranks of CEOs, middle-level managers, and other staff in the cooperative movement, how can you advise them on retirement planning?

(Smiling) Retirement is not a walk in the park. You need to start early to have time to know who your neighbors are for your happy stay in the community. Capital cash investment projects should be implemented while you are still active in employment so that when you retire, you should be on-site to improve on management skills. Your monthly income in your retirement should be 75 per cent of your last earnings for you to maintain your status in society.

By Our Reporter.

Get more stories from our website: Sacco Review.

For comments and clarifications, write to: Saccoreview@

Kindly follow us via our social media pages on Facebook: Sacco Review Newspaper for timely updates

Stay ahead of the pack! Grab the latest Sacco Review newspaper!