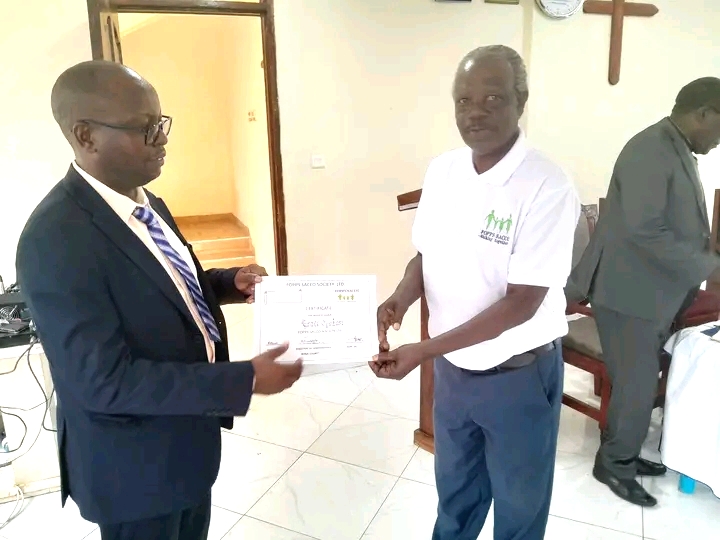

Former Public and Private Sector Cooperative Society (FOPPS) Sacco have entered into a contract with Cooperative Bank as the Last Expense Cover for its members.

In a speech during the FOPPS Sacco Annual General Meeting at ACK Guest House in Amagoro, Busia County, National Chairman and founder Ben Akwara said the Last Expense Policy Cover of KSh150,000 which they entered into contract with the Bank invites an annual premium of KSh6,600 from both parties remittable in full and covers up to 10 beneficiaries.

The Last Expense Cover provides for the payment of a selected sum assured to the dependents of a deceased member to cater for burial expenses to ease the burden of meeting funeral expenses.

However, Akwara disclosed that a total of KSh3.4 billion had been disbursed to members as loans as at KSh2.9 million in 2022, noting that although loan uptake had gradually increased, over time, recovery has been rather sluggish.

“I therefore ask borrowers to consistently service their loans in order to allow other members to borrow. I propose that each loanee be levied KSh200 per loan starting June 2024 for us to carter for the annual loan policy.

READ ALSO:

Troubled Metropolitan Sacco AGM ends unceremoniously in Kiambu

On investment savings, the management team is in the process of reviewing the investment policy and introducing new changes at this trading arm of Sacco to make it more profitable in future.

He added: “Our total share capital as at December 31, 2023 had grown to KSh1.07 million, up from KSh812,000 while the SACCO realised a net income of KSh30,374 less 20 per cent statutory reserves of KSh6073, leaving the Sacco with KSh24,299.

Key achievements the SACCO realized include being granted a borrowing power from Commissioner of Cooperatives, thus accessingan external loan facility of KSh870,000 from Kenya Union of Savings & Credit Co-operatives Ltd (KUSCCO) which is being used to loan to members.

Other achievements include sourcing for spacious office at the Amagoro ACK Guest House grounds, recruitment of 90 Sacco members, and who have added a significant contribution to Sacco shares.

Malaba Cooperative Bank Manager Obed Mogaka concurred with Akwara saying that there is need by members to service their loans to pay the loans or members’ funds.

“Coop Bank started as SACCO before it transitioned to a bank,” he said, noting that Co-op Bank is a bank of saccos. We have what it takes to transform FOPPS to be a giant,” he said.

By Godfrey Wamalwa

Get more stories from our website: Sacco Review.

For comments and clarifications, write to: Saccoreview@

Kindly follow us via our social media pages on Facebook: Sacco Review Newspaper for timely updates

Stay ahead of the pack! Grab the latest Sacco Review newspaper!