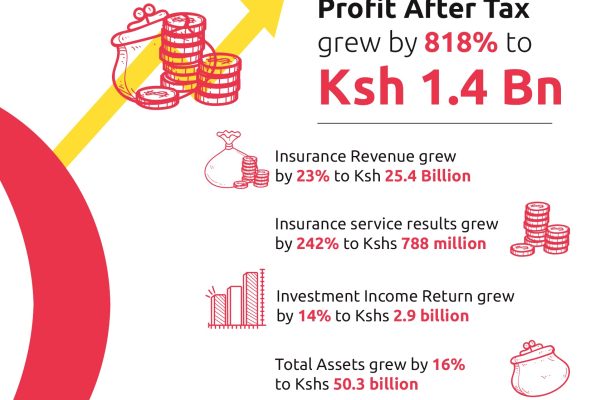

Equity Group reports 32 per cent third quarter profit resulting to Kshs 54.1 Billion

Equity Group Holdings Plc has reported a 32% rise in Profit after Tax to Kshs 54.1 billion for the third quarter of 2025, up from Kshs 40.9 billion, driven by diversified revenue growth, cost efficiency, and strong regional performance. The Group’s return on equity stood at 26.4%, with return on assets at 4.1%. Net interest…