By Azael Masese

Tembo Sacco celebrated its 50th anniversary, a period in which it braved a tough journey to cruise to a solid balance sheet and stable liquidity ratios.

While marking the golden jubilee on June 17, 2022 at the EABL grounds, members recounted the tumultuous journey it took to be able to get a return on their investment.

A period interwoven by bright and dull moments, it did not, however, deter their ambition to become the largest shareholder of Tembo House, a prime property located in Nairobi’s Central Business District (CBD), which enables retirees to earn an income even in their sunset days.

Sacco’s Chief Executive Officer (CEO) Lydia Mungai said the tough times, rather than dampen their spirit to push forward, helped them focus even more on turning around their fortunes. They bravely opened other investment arms that enabled members claim a stake on a number of properties.

“I hear of legends like the late (Kenneth) Matiba. Some did very well. Others not so well. Some days were bright and beautiful, others were grey and dull. The Sacco had its glorious moments and other days, would not rather talk about. But that past has forged us and made us strong,” she said.

Mrs. Mungai appealed to members, partners and stakeholders to join the society in a strong resolve of making a positive change in the society.

“We step into the next 50 years with enthusiasm and energy, determined to continue doing that for which we exist: changing lives for better economically,” she emphatically stated.

In its 50-year journey, the society has purchased Trio Complex, which formerly served as the EABL head office.

It bought the house when EABL wanted to offload some of its fixed assets, taking advantage of the preferential treatment of the Sacco by the company.

The society continued offering savings and credit business until 1989 when they formed Tembo Investment Cooperative Society.

“This helped acquire Tembo Cooperative House located in Nairobi’s CBD, out of which investment members continue enjoying returns to date,” noted Board Chair Peter Kiguru, adding that it was a significant boost to the ordinary income from the society’s normal operations.

The society formed Tembo Ventures Housing Cooperative Limited and more recently, Tembo Trio Investment Company Ltd to help members acquire land and other properties.

“These are run by independent Board of Directors to afford the society time to focus on savings and credit services,” he said.

The society also engaged in an aggressive purchase of Co-operative Bank shares in the 1980s and 1990s, which has enabled members earn a return on their investment every year.

It acquired Tembo Complex located at Garden Estate where Sacco operations are conducted, as two office floors are rented out to earn the Sacco an extra income.

To cement its financial position, it started FOSA activities in 2002 so that members could open accounts for withdrawable deposits such as salaries.

“The Fosa operations have helped stabilize the liquidity position of the Sacco as we are able to attract withdrawable deposits,” said Kiguru.

The biggest strategic decision the society made was in 2008 when it launched its first 5-year strategic plan.

“Since then, we have had a roadmap and this has not only led to tremendous growth in the society but also helped us improve greatly in risk management and governance,” asserted the Sacco Chair, adding that they pride in being able to deliver quality services to members efficiently and in a cost-effective manner.

In its tumultuous journey though, the society has bagged several accolades during the Ushirika Day celebrations and delivered reasonable returns to members while ensuring loans remained competitive.

On its leadership policy, one can be a Board member for a maximum of six years or two terms of 3 years each to ensure the best delivery of service while allowing fresh ideas to sprout.

In a speech read by Nairobi County Cooperative Director Dolphine Aremo, Obonyo disclosed that the society had graduated to Tier 1 category after attaining an asset base of Sh.4.5 billion with member deposits clocking Sh.3 billion.

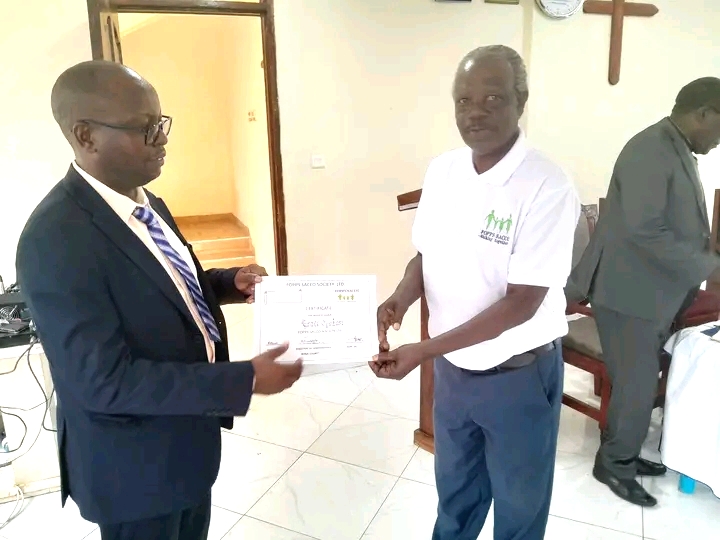

Longest serving employees, youngest savers, and members who have been with the society the longest were awarded during the event.

Those who graced the occasion include Sasra CEO Peter Njuguna, Co-operative Bank Director Banking Division Vincent Marangu, Qwetu Sacco Chair Alfred Mlolwa, Shirika Sacco CEO John Kirika, Nation Sacco Board Chair Peter Munaita, and KUSCCO regional Senior Manager Arnold Munene.