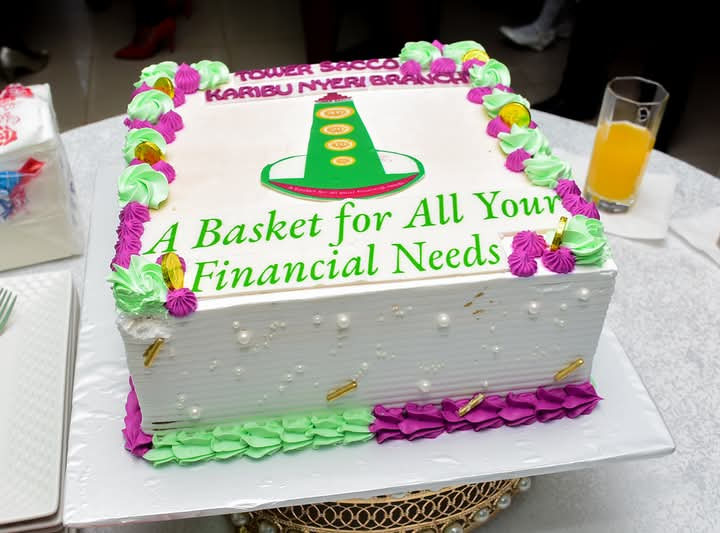

Tower Sacco, one of Kenya’s leading Savings and Credit Cooperative Organizations, has officially opened its Nyeri branch, marking a significant milestone as the sacco now boasts 30 branches across nine counties.

The grand opening was graced by H.E. David Kinaniri Waroe, representing Nyeri Governor H.E. Mutahi Kahiga, PhD., EGH. In his address, Waroe commended Tower Sacco for investing in Nyeri County and assured them of the full support of the County Government.

“I wish to thank Tower SACCO for choosing Nyeri as part of its expansion strategy. The County Government is committed to supporting cooperative societies as they play a crucial role in financial empowerment,” he said.

Founded in 1977, Tower SACCO has grown into one of Kenya’s most reputable financial cooperatives, with an asset base of Ksh. 28 billion and a membership of nearly 200,000 individuals. The SACCO provides savings, loans, and investment opportunities designed to enhance the financial well-being of its members.

Nyeri Trade, Tourism & Cooperative Development CECM Diana Kendi, Chief Officer George Mwangi, and Acting Director Monica Wachira were among the county officials present at the event, underscoring the importance of SACCOs in local economic development.

Tower SACCO has demonstrated remarkable growth in recent years. As of December 2024, the following achievements were recorded:

- Member Deposits and Share Capital: Ksh. 22.5 billion

- Loans Issued in 2024: Ksh. 15.6 billion

- Total Loans Held by Members: Ksh. 22.6 billion, an increase from Ksh. 23.2 billion in 2023 to Ksh. 28 billion in 2024.

- Revenue and Member Returns: Generated Ksh. 4.3 billion in revenue, with a surplus of Ksh. 2.9 billion before rebate payments. Dividends on share capital were distributed at Ksh. 20 per share, totaling Ksh. 311 million, while rebates on non-withdrawable deposits amounted to Ksh. 2.06 billion at a 13% rate.

Tower SACCO has integrated modern technology to enhance service delivery. Through mobile banking, internet banking, agency banking, and ATM services, members can conveniently manage their accounts, apply for loans, and conduct transactions remotely.

To cater to Kenyans abroad, the SACCO has also established a Diaspora Department, allowing members to save, invest, and access credit facilities from anywhere in the world.

As part of its Corporate Social Responsibility (CSR), Tower SACCO supports bright but needy students, currently sponsoring 33 students in National and Extra County schools. Additionally, the SACCO is actively involved in environmental conservation, partnering with the government and stakeholders in tree-planting programs. Support for orphanages and special needs schools further reflects the organization’s commitment to social welfare.

YOU MAY ALSO READ:

Government urged to prioritize agriculture for national prosperity

Tower SACCO continues to forge strategic partnerships with organizations like the Women Enterprise Fund (WEF), Kenya Mortgage Refinance Company (KMRC), and Startimes, which is collaborating with the SACCO to provide green energy solutions through solar power financing.

Membership is open to all individuals, including professionals, business owners, and those in the diaspora. One can apply online or visit any branch to complete registration. Members benefit from affordable credit, high returns on investments, and flexible savings plans.

As Tower SACCO continues its expansion, its presence in Nyeri marks another step in empowering individuals financially and driving economic growth. With a solid financial foundation, cutting-edge technology, and a strong commitment to community development, the SACCO remains a pillar of financial stability and prosperity for thousands of Kenyans.

By Rodgers Wagura.

Get more stories from our website: Sacco Review.

For comments and clarifications, write to: Saccoreview@

Kindly follow us via our social media pages on Facebook: Sacco Review Newspaper for timely updates

Stay ahead of the pack! Grab the latest Sacco Review newspaper!