By Obegi Malack

obegimalack@gmail.com

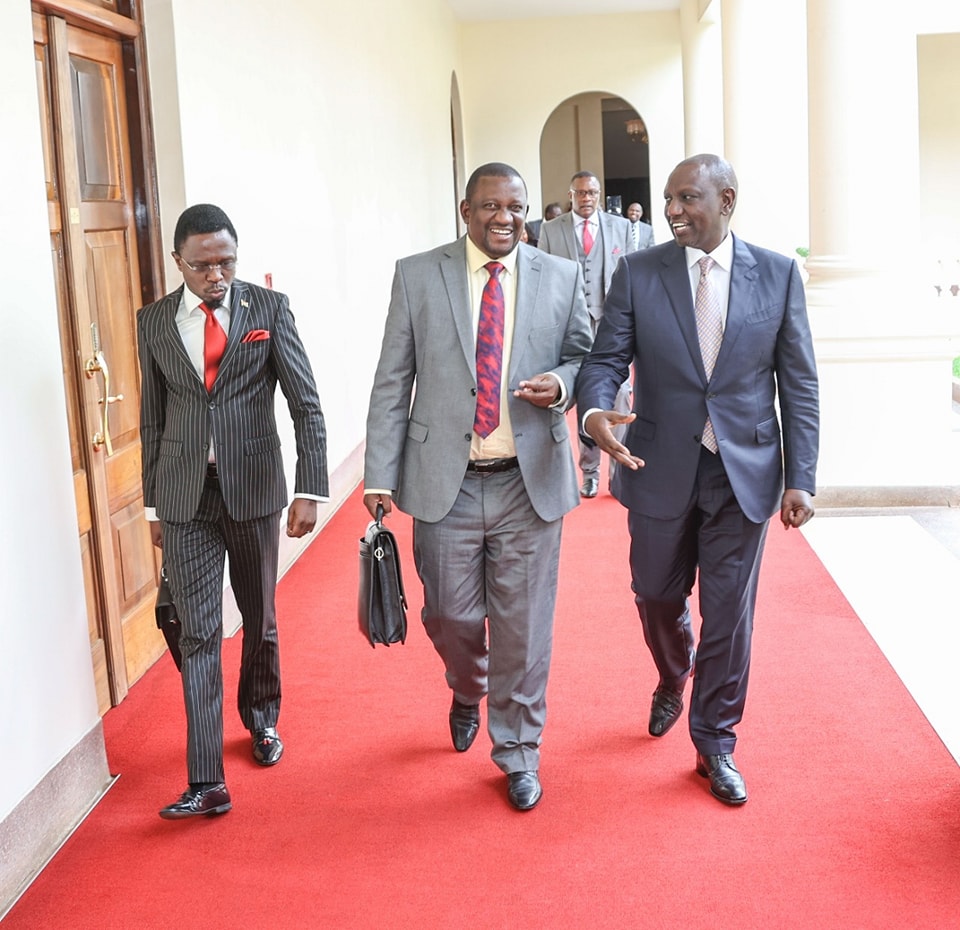

The government has approved the legal and institutional framework to anchor the establishment and implementation of the financial inclusion fund (Hustlers Fund) which was in President William Ruto’s pre-election manifesto.

The first phase roll out of the fund is expected to be launched on November 30, this year.

Kenyans will be able to access loans of between Sh500-Sh50, 000 through the fund at an interest of 8 per cent per year and computed on a pro-rated basis.

According to a statement from statehouse it indicated that the implementation of the administration’s signature pledge is tipped to liberate Kenyans from the bond of predatory lending.

The Sh50 billion funds is part of Ruto’s pledge to uplift Small and medium-sized enterprises (SMEs) through the “Bottom-up” approach.

Recently, the National Treasury unveiled regulations that will govern the fund under the Public Finance Management Act.

Kenyans who would like to benefit from the Hustlers Fund are required to have Kenyan Identity cards.

For one to benefit from the programme one is required to member of Micro, Small, and Medium Enterprises (MSMEs), SACCOs, Chama and table banking groups, or any other registered association.

The Hustlers’ Fund will be administered by Chief Executive Officers (CEO) who will be appointed by the Treasury CS.

The CEO will be obligated to open and operate the fund bank accounts with the approval of the Board and the National Treasury, the officer will also supervise and control the day-to-day administration of the Fund.

Other roles the CEO is expected to do is to transmit the Auditor-General statement of accounts relating to the Fund and show the expenditure incurred from the Fund each financial year.

Treasury had outlined serious offences that will see individuals fined up to Sh10 million or an alternative jail term of five years. The offences include misappropriation of funds, failure to give information, or falsifying information while applying for the fund.

“Having possession of ,control over, or access to any documents, information, returns or forms and communicates anything contained therein to any person other than a person to whom he is authorized by the Board to communicate it; or otherwise than for the purposes of these Regulations,” the regulations stated.